I. Introduction

Auto insurance is a crucial aspect of responsible vehicle ownership, providing financial protection against accidents, theft, and other unforeseen events. However, with the myriad of options available in the market, shopping for auto insurance rates can be a daunting task. This comprehensive guide will walk you through the process of how to shop auto insurance rates effectively, ensuring you find the best coverage at the most competitive price.

Why is shopping for auto insurance rates so important? The answer lies in the potential for significant savings and better coverage. Insurance companies use complex algorithms to determine rates, and these can vary widely between providers. By taking the time to shop around and compare auto insurance rates, you could potentially save hundreds of dollars annually while still maintaining the coverage you need.

In this article, we’ll cover everything you need to know about shopping for auto insurance rates, from understanding the basics of coverage to strategies for finding the best deals. We’ll also provide tips on how to compare quotes effectively, avoid common pitfalls, and manage your policy after purchase.

II. Understanding Auto Insurance Basics

Before you start to shop auto insurance rates, it’s essential to understand the fundamentals of auto insurance. This knowledge will empower you to make informed decisions and ensure you’re getting the right coverage for your needs.

A. Types of Auto Insurance Coverage

Auto insurance policies typically consist of several types of coverage. Here’s a breakdown of the most common types:

- Liability Coverage: This is the most basic form of auto insurance, required by law in most states. It covers damages or injuries you cause to others in an accident.

- Collision Coverage: This pays for damage to your own vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: This protects your vehicle from non-collision related incidents such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Also known as “no-fault” insurance, PIP covers medical expenses for you and your passengers, regardless of who’s at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re in an accident with a driver who has insufficient or no insurance.

B. Minimum Coverage Requirements by State

When you shop auto insurance rates, it’s important to know that each state has its own minimum coverage requirements. These typically include liability coverage with specific limits. For example, a state might require a minimum of 25/50/25, which means:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

It’s crucial to note that while meeting your state’s minimum requirements is legally necessary, it may not provide adequate protection in all scenarios. As you shop for auto insurance rates, consider whether you need coverage beyond the minimum requirements.

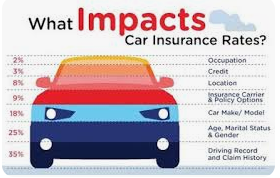

C. Factors That Affect Auto Insurance Rates

Understanding what influences auto insurance rates can help you as you shop for the best deals. Insurance companies consider numerous factors when calculating premiums, including:

- Age and driving experience

- Driving record and claims history

- Type of vehicle and its safety features

- Annual mileage

- Credit score (in most states)

- Location (urban areas typically have higher rates)

- Coverage levels and deductibles

By understanding these factors, you can better anticipate how they might affect your rates as you shop for auto insurance. Keep in mind that different insurers may weigh these factors differently, which is why it’s so important to compare quotes from multiple providers.

III. Preparing to Shop for Auto Insurance Rates

Before you start actively shopping for auto insurance rates, it’s crucial to prepare yourself with the right information and mindset. This preparation will make the process more efficient and help you find the best rates for your specific situation.

A. Assessing Your Coverage Needs

Take time to evaluate your unique circumstances and determine the level of coverage you require. Consider factors such as:

- The value of your vehicle

- Your assets that could be at risk in a lawsuit

- Your typical driving habits and environment

- Your budget for insurance premiums

Remember, while it’s tempting to opt for the minimum required coverage to save money, this may leave you financially vulnerable in the event of a serious accident.

B. Gathering Necessary Information

To get accurate quotes as you shop auto insurance rates, you’ll need to have specific information ready. Collect the following details:

- Vehicle Details: Make, model, year, Vehicle Identification Number (VIN), safety features, and anti-theft devices.

- Driving History: Your driver’s license number, accident history, traffic violations, and any completed defensive driving courses.

- Current Policy Information: If you’re currently insured, have your policy details handy for comparison.

C. Setting a Budget

Determine how much you can comfortably afford to spend on auto insurance. This will help you narrow down your options as you shop for rates. Remember to balance cost with adequate coverage – the cheapest option isn’t always the best in the long run.

IV. Where to Shop for Auto Insurance Rates

When it’s time to start shopping for auto insurance rates, you have several options. Each has its advantages, and it’s often beneficial to explore multiple channels to ensure you’re getting the best rates and coverage.

A. Direct Insurers

Many large insurance companies allow you to shop for auto insurance rates directly through their websites or by calling their sales representatives. This can be a straightforward approach, especially if you have a particular insurer in mind. However, remember that you’re only seeing rates from one company at a time.

B. Independent Agents

Independent insurance agents represent multiple insurance companies and can shop auto insurance rates on your behalf. They can provide personalized advice and may have access to discounts or policies not available to the general public. However, they may not represent every available insurer in your area.

C. Online Comparison Tools

Numerous websites allow you to compare auto insurance rates from multiple providers simultaneously. These can be extremely useful for getting a broad overview of available rates quickly. Keep in mind that not all insurers participate in these comparison tools, so you might miss out on some options.

D. Insurance Marketplaces

Some states operate their own insurance marketplaces where you can shop for auto insurance rates from various providers. These can be a good resource for understanding what’s available in your area and often provide educational resources about insurance.

V. Tips for Comparing Auto Insurance Rates

As you shop auto insurance rates, it’s important to compare quotes effectively to ensure you’re making an informed decision. Here are some key tips to keep in mind:

A. Getting Quotes from Multiple Providers

Don’t settle for the first quote you receive. Aim to get quotes from at least three different insurance providers. This will give you a better sense of the range of rates available and increase your chances of finding the best deal.

B. Ensuring Consistent Coverage Levels Across Quotes

When you shop for auto insurance rates, make sure you’re comparing apples to apples. Ensure that each quote includes the same types and levels of coverage. A policy might seem cheaper, but it could be offering less protection.

C. Understanding Discounts and How They Apply

Many insurers offer discounts that can significantly reduce your premiums. Common discounts include:

- Safe driver discount

- Multi-policy discount (for bundling auto with home or life insurance)

- Good student discount

- Vehicle safety feature discount

- Paid-in-full discount

Ask each insurer about available discounts and how they’re applied to your quote.

D. Checking Financial Stability and Customer Reviews of Insurers

While price is important, it’s not the only factor to consider as you shop auto insurance rates. Check the financial stability of potential insurers through ratings agencies like A.M. Best or Standard & Poor’s. Additionally, look at customer reviews and complaint ratios to gauge the quality of service you can expect.

VI. Strategies to Lower Your Auto Insurance Rates

As you shop for auto insurance rates, consider these strategies that could help you secure lower premiums:

A. Increasing Deductibles

Opting for a higher deductible can lower your premium. However, ensure you can afford the higher out-of-pocket cost if you need to make a claim.

B. Bundling Policies

Many insurers offer discounts if you bundle your auto insurance with other policies like home or life insurance.

C. Improving Credit Score

In many states, insurers use credit-based insurance scores to help determine premiums. Improving your credit score could lead to lower rates.

D. Taking Advantage of Safe Driver Programs

Many insurers offer programs that track your driving habits and reward safe driving with lower rates.

E. Exploring Usage-Based Insurance Options

If you don’t drive much, usage-based or pay-per-mile insurance could result in significant savings.

VII. Conclusion

Shopping for auto insurance rates doesn’t have to be a daunting task. By understanding the basics of auto insurance, preparing adequately, exploring various shopping channels, and comparing quotes effectively, you can find the best coverage at the most competitive price. Remember, the goal isn’t just to find the cheapest rate, but to secure comprehensive coverage that provides peace of mind on the road.

As you shop auto insurance rates, keep in mind that your insurance needs may change over time. It’s a good practice to review your coverage annually or whenever you experience significant life changes. By staying proactive and informed, you can ensure that you always have the right coverage at the best possible rate.

VIII. FAQs About Shopping for Auto Insurance Rates

Q: How can I get the cheapest auto insurance rates?

A: While the cheapest rates aren’t always the best, you can lower your premiums by maintaining a clean driving record, improving your credit score, choosing a higher deductible, and taking advantage of available discounts.

Q: Does my credit score affect my auto insurance rates?

A: In most states, yes. Insurers often use credit-based insurance scores as one factor in determining premiums. However, some states have banned this practice.

Q: What discounts should I look for when shopping for auto insurance?

A: Common discounts include safe driver, multi-policy, good student, vehicle safety feature, and paid-in-full discounts. Always ask insurers about all available discounts when you shop for auto insurance rates.

Q: How much auto insurance coverage do I really need?

A: This depends on your individual circumstances. At minimum, you need to meet your state’s requirements. However, it’s often advisable to have higher limits to protect your assets. Consider factors like the value of your car, your typical driving habits, and your personal financial situation.

Q: Can I switch auto insurance providers before my policy expires?

A: Yes, you can typically switch providers at any time. However, some insurers may charge a cancellation fee if you end your policy early. Be sure to have your new policy in place before cancelling your old one to avoid a lapse in coverage.

Leave a Comment