Introduction

Auto insurance is a crucial aspect of responsible vehicle ownership in Massachusetts. As a driver in the Bay State, understanding how to obtain and compare auto insurance quotes in MA can save you money and ensure you have the right coverage for your needs. This comprehensive guide will walk you through everything you need to know about getting the best auto insurance quote in Massachusetts.

Massachusetts law requires all drivers to carry minimum levels of auto insurance coverage. However, the process of obtaining quotes and choosing the right policy can be complex. By learning how to navigate the world of MA auto insurance quotes, you can make informed decisions that protect both your vehicle and your financial well-being.

Comparing auto insurance quotes in MA is crucial for several reasons:

- Cost savings: Rates can vary significantly between insurers, even for the same coverage.

- Customized coverage: Different companies may offer unique options that better suit your needs.

- Customer service: The quality of service and claims handling can differ among insurers.

- Financial stability: Some companies may be more financially sound than others, affecting their ability to pay claims.

In this guide, we’ll explore the intricacies of Massachusetts auto insurance, help you understand how to obtain and interpret quotes, and provide valuable tips for securing the best coverage at the most competitive rates.

Understanding Auto Insurance in Massachusetts

Before diving into the process of getting an auto insurance quote in MA, it’s essential to understand the basics of auto insurance in the state.

Minimum Coverage Requirements

Massachusetts has specific minimum coverage requirements that all drivers must meet. These include:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury to Others | $20,000 per person, $40,000 per accident |

| Personal Injury Protection (PIP) | $8,000 per person, per accident |

| Bodily Injury Caused by an Uninsured Auto | $20,000 per person, $40,000 per accident |

| Damage to Someone Else’s Property | $5,000 per accident |

It’s important to note that while these are the minimum requirements, they may not provide adequate protection in all situations. When getting an auto insurance quote in Massachusetts, consider higher coverage limits for better protection.

Optional Coverages Available

In addition to the mandatory coverages, MA insurance companies offer several optional coverages that you may want to consider when getting quotes:

- Collision Coverage: Pays for damage to your car from a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage to your car from non-collision incidents like theft, vandalism, or natural disasters.

- Medical Payments: Provides additional medical coverage beyond PIP.

- Rental Car Coverage: Pays for a rental car while your vehicle is being repaired after a covered accident.

- Roadside Assistance: Offers help if your car breaks down or you’re locked out.

- Gap Insurance: Covers the difference between your car’s actual cash value and what you owe on your auto loan if your car is totaled.

When obtaining auto insurance quotes in MA, consider which of these optional coverages might be beneficial for your situation.

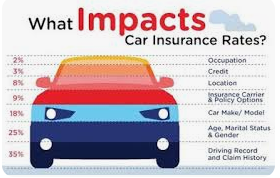

Factors Affecting Auto Insurance Rates in MA

Several factors can influence your auto insurance rates in Massachusetts:

- Driving Record: A clean driving history typically results in lower rates.

- Vehicle Type: The make, model, and age of your car affect your premium.

- Location: Where you live in MA can impact your rates due to factors like crime rates and accident statistics.

- Age and Experience: Younger, less experienced drivers often pay higher rates.

- Credit Score: While MA prohibits using credit scores as the sole factor in setting rates, it may still be considered in some cases.

- Annual Mileage: The more you drive, the higher your risk of an accident, which can increase your rates.

- Coverage Levels: Higher coverage limits and lower deductibles generally result in higher premiums.

Understanding these factors can help you make informed decisions when comparing auto insurance quotes in Massachusetts and potentially find ways to lower your rates.

How to Get an Auto Insurance Quote in MA

Obtaining an auto insurance quote in MA is a straightforward process, but it’s important to explore multiple options to ensure you’re getting the best coverage at the most competitive rate. Here are the main methods for getting quotes:

Online Quote Tools

Many insurance companies offer online tools that allow you to get a quick auto insurance quote in Massachusetts. These tools typically require you to enter information such as:

- Personal details (name, age, address)

- Vehicle information (make, model, year)

- Driving history

- Desired coverage levels

Online quote tools are convenient and allow you to compare rates quickly. However, they may not always provide the most accurate quotes, especially for complex situations.

Working with Local Insurance Agents

Local insurance agents can provide personalized service and expert advice when you’re seeking an auto insurance quote in MA. They can:

- Assess your specific needs and risk factors

- Explain coverage options in detail

- Offer insights into local insurance regulations and trends

- Help you find discounts you might not be aware of

Working with an agent can be particularly beneficial if you have a complex insurance situation or prefer face-to-face interactions.

Contacting Insurance Companies Directly

You can also reach out to insurance companies directly to get auto insurance quotes in Massachusetts. This method allows you to:

- Ask specific questions about coverage options

- Inquire about company-specific discounts or programs

- Get a feel for the company’s customer service

Keep in mind that contacting companies individually can be time-consuming, and you’ll need to repeat the process for each insurer you’re considering.

Comparison Websites for MA Auto Insurance Quotes

Comparison websites can be a useful tool for getting multiple auto insurance quotes in MA simultaneously. These platforms allow you to:

- Enter your information once and receive quotes from multiple insurers

- Compare rates and coverage options side-by-side

- Access customer reviews and ratings for different insurance companies

While comparison sites can save time, it’s important to note that they may not include all available insurers, and the quotes provided might not be as accurate as those obtained directly from insurers.

Key Factors Influencing Your MA Auto Insurance Quote

When you’re seeking an auto insurance quote in Massachusetts, several key factors will influence the rates you’re offered. Understanding these factors can help you anticipate your costs and potentially find ways to lower your premiums.

Driving Record and Claims History

Your driving record is one of the most significant factors affecting your auto insurance quote in MA. Insurers consider:

- Traffic violations

- At-fault accidents

- DUI convictions

- Previous insurance claims

A clean driving record typically results in lower premiums, while a history of violations or accidents can significantly increase your rates.

Vehicle Make, Model, and Age

The characteristics of your vehicle play a crucial role in determining your MA auto insurance quote. Insurers consider:

- Safety ratings and features

- Likelihood of theft

- Cost of repairs

- Overall value of the vehicle

Generally, newer, more expensive cars cost more to insure, while vehicles with high safety ratings may qualify for discounts.

Location Within Massachusetts

Where you live in MA can significantly impact your auto insurance rates. Factors that insurers consider include:

- Urban vs. rural areas (urban areas typically have higher rates)

- Local crime rates, especially auto theft

- Frequency of accidents in your area

- Weather patterns that might increase the risk of damage

For example, drivers in Boston might see higher rates than those in less densely populated areas of Massachusetts.

Credit Score (in Some Cases)

While Massachusetts law prohibits insurers from using credit scores as the sole factor in setting rates, your credit history may still play a role in some cases. Insurers may consider your credit-based insurance score, which is different from your regular credit score, as part of their risk assessment.

Annual Mileage

The number of miles you drive annually can affect your auto insurance quote in Massachusetts. Generally:

- Higher annual mileage = Higher risk of accidents = Higher premiums

- Lower annual mileage = Lower risk of accidents = Potential for lower premiums

Some insurers offer low-mileage discounts for drivers who don’t spend much time on the road.

Coverage Levels and Deductibles

The coverage levels you choose and your deductible amount directly impact your MA auto insurance quote:

- Higher coverage limits result in higher premiums

- Lower deductibles (the amount you pay out of pocket in a claim) lead to higher premiums

- Higher deductibles can lower your premiums but mean more out-of-pocket expenses if you file a claim

It’s important to balance adequate coverage with affordable premiums when selecting your policy details.

Tips for Lowering Your Auto Insurance Quote in MA

While many factors affecting your auto insurance quote in Massachusetts are beyond your control, there are several strategies you can employ to potentially lower your premiums:

Bundling Policies

One of the most effective ways to reduce your MA auto insurance quote is by bundling multiple policies with the same insurer. This typically involves combining your auto insurance with other types of coverage, such as:

- Homeowners or renters insurance

- Life insurance

- Umbrella insurance

Many insurers offer significant discounts, often ranging from 5% to 25%, for customers who bundle policies. This approach not only saves money but also simplifies your insurance management.

Increasing Deductibles

Opting for a higher deductible can substantially lower your auto insurance quote in MA. For example:

| Deductible | Potential Premium Reduction |

|---|---|

| $500 to $1,000 | 10-20% |

| $1,000 to $2,000 | 15-30% |

However, it’s crucial to ensure you can afford the higher out-of-pocket cost if you need to file a claim.

Taking Advantage of Discounts

Massachusetts auto insurers offer various discounts that can significantly reduce your premiums. Some common discounts include:

1. Good Driver Discounts

Maintaining a clean driving record can lead to substantial savings, often up to 20% or more.

2. Safety Feature Discounts

Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and anti-theft devices may qualify for discounts.

3. Multi-Car Discounts

Insuring multiple vehicles with the same company can lead to savings of 10-25% on each policy.

4. Good Student Discounts

Full-time students with good grades (typically a B average or better) may qualify for discounts of up to 25%.

Always ask your insurer about all available discounts when getting an auto insurance quote in Massachusetts.

Maintaining a Clean Driving Record

A clean driving record is one of the most effective ways to keep your MA auto insurance quote low. To maintain a good record:

- Obey traffic laws and speed limits

- Avoid distracted driving

- Never drive under the influence of alcohol or drugs

- Consider taking a defensive driving course

In Massachusetts, participating in the Safe Driver Insurance Plan (SDIP) can lead to significant discounts for drivers with clean records.

Improving Credit Score

While Massachusetts restricts the use of credit scores in setting auto insurance rates, maintaining good credit can still be beneficial. Some ways to improve your credit score include:

- Paying bills on time

- Reducing credit card balances

- Avoiding opening new credit accounts unnecessarily

- Regularly checking your credit report for errors

A better credit score can potentially lead to more favorable auto insurance quotes in MA, especially if you’re also shopping for other types of insurance.

Common Mistakes to Avoid When Getting an Auto Insurance Quote in MA

When seeking an auto insurance quote in Massachusetts, be aware of these common pitfalls:

Not Shopping Around

One of the biggest mistakes is accepting the first quote you receive. Always compare quotes from multiple insurers to ensure you’re getting the best rate. A recent study showed that MA drivers could save an average of 35% by comparing quotes from different companies.

Providing Inaccurate Information

Giving incorrect information when requesting an auto insurance quote in MA can lead to inaccurate pricing or even policy cancellation. Be sure to provide accurate details about:

- Your driving history

- Annual mileage

- Vehicle specifications

- Primary driver and additional drivers

Focusing Solely on Price

While it’s important to find affordable coverage, the cheapest MA auto insurance quote isn’t always the best option. Consider factors such as:

- Coverage limits and exclusions

- Customer service ratings

- Claims process and satisfaction

- Financial stability of the insurer

Overlooking Important Coverages

Don’t make the mistake of opting for only the minimum required coverage to save money. Consider additional protections like:

- Comprehensive coverage

- Collision coverage

- Uninsured/underinsured motorist coverage

- Rental car coverage

These additional coverages can provide crucial financial protection in various scenarios.

Failing to Review Quotes Thoroughly

When comparing auto insurance quotes in Massachusetts, make sure you’re comparing apples to apples. Pay attention to:

- Coverage limits for each type of protection

- Deductible amounts

- Exclusions and limitations

- Discounts applied

Take the time to read through each quote carefully and ask questions if anything is unclear.

Understanding Your MA Auto Insurance Quote

When you receive an auto insurance quote in Massachusetts, it’s crucial to understand all its components to make an informed decision. Let’s break down the key elements:

Breaking Down the Components of a Quote

A typical MA auto insurance quote will include the following information:

- Premium: The amount you’ll pay for your policy, usually offered as both a monthly and annual figure.

- Coverage types: A list of the different coverages included in the quote, such as liability, collision, comprehensive, etc.

- Coverage limits: The maximum amount the insurer will pay for each type of coverage.

- Deductibles: The amount you’ll need to pay out of pocket before your insurance kicks in.

- Discounts applied: Any savings you’re eligible for based on your profile or choices.

- Policy period: The duration for which the quoted price is valid, typically six months or one year.

Interpreting Coverage Limits and Deductibles

Understanding coverage limits and deductibles is crucial when evaluating your auto insurance quote in MA:

Coverage Limits

These are often expressed as three numbers, for example, 100/300/100. This means:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $100,000 property damage liability per accident

Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and $2,000 in damage:

- You pay: $500

- Your insurer pays: $1,500

Higher deductibles generally mean lower premiums, but make sure you can afford the out-of-pocket cost if you need to file a claim.

Comparing Quotes from Different Providers

When comparing auto insurance quotes in Massachusetts from different providers, consider the following:

- Coverage levels: Ensure you’re comparing quotes with the same coverage limits and types.

- Deductibles: Check that deductibles are the same across quotes.

- Discounts: Look at which discounts are applied and if you qualify for any additional ones.

- Add-ons: Consider any additional features or benefits offered by each insurer.

- Company reputation: Research customer reviews and financial stability ratings.

Create a spreadsheet or use a comparison tool to easily view these factors side by side.

Special Considerations for MA Auto Insurance Quotes

When seeking an auto insurance quote in MA, there are several unique factors to consider due to state-specific regulations and conditions:

Massachusetts Auto Insurance Reform

In 2008, Massachusetts implemented auto insurance reform, moving from a “fixed and established” system to a managed competition system. This change allows insurers more flexibility in setting rates, potentially leading to more competitive auto insurance quotes in MA. Key points to remember:

- Insurers can now offer their own discounts and incentives.

- Rates can vary more significantly between companies.

- Consumers have more options and greater incentive to shop around.

SDIP (Safe Driver Insurance Plan) and its Impact on Quotes

The Safe Driver Insurance Plan (SDIP) is a point-based system in Massachusetts that can significantly affect your auto insurance quote in MA. Here’s how it works:

- Drivers start with 0 points.

- Points are added for at-fault accidents and traffic violations.

- More points generally lead to higher insurance premiums.

- Clean driving records can lead to substantial discounts.

For example, a driver with 0 SDIP points might receive a 15-20% discount on their premium, while a driver with 4 points could see a 30-40% increase.

MA Auto Insurance for High-Risk Drivers

If you’re considered a high-risk driver in Massachusetts, getting an affordable auto insurance quote can be challenging. High-risk drivers may include those with:

- Multiple traffic violations

- DUI convictions

- Multiple at-fault accidents

- Lapses in insurance coverage

In such cases, you might need to explore the Massachusetts Automobile Insurance Plan (MAIP), which assigns high-risk drivers to insurance companies. While rates through MAIP are typically higher, it ensures that all drivers can obtain the required coverage.

Seasonal Considerations for Auto Insurance in MA

Massachusetts experiences diverse weather conditions that can impact your auto insurance quote and coverage needs:

- Winter driving: Consider comprehensive coverage for protection against weather-related damages.

- Seasonal vehicles: If you have a vehicle you only use part of the year (e.g., a convertible or motorcycle), ask about seasonal policies or usage-based insurance options.

- Flood-prone areas: If you live in a flood-prone area, ensure your policy covers flood damage, as it’s not typically included in standard policies.

Discussing these seasonal factors with your insurance provider can help ensure you have appropriate coverage year-round.

Frequently Asked Questions About Auto Insurance Quotes in MA

To help you navigate the process of obtaining an auto insurance quote in Massachusetts, here are answers to some commonly asked questions:

How often should I get new auto insurance quotes in MA?

It’s recommended to shop around for new auto insurance quotes in MA at least once a year, or whenever you experience significant life changes such as:

- Moving to a new address

- Purchasing a new vehicle

- Adding or removing drivers from your policy

- Major changes in your credit score

- Significant improvements in your driving record

Regular comparison shopping ensures you’re always getting the best rates and coverage for your current situation.

Can I get an auto insurance quote in MA without personal information?

While you can get a general estimate without providing detailed personal information, accurate MA auto insurance quotes typically require:

- Name and address

- Date of birth

- Vehicle information (make, model, year, VIN)

- Driving history

- Current insurance information

Providing this information allows insurers to give you a more accurate quote based on your specific risk profile.

How do MA auto insurance quotes compare to other states?

Massachusetts auto insurance rates tend to be higher than the national average. According to recent data:

| Average Annual Premium | Massachusetts | National Average |

|---|---|---|

| Full Coverage | $1,223 | $1,674 |

| Minimum Coverage | $463 | $565 |

Factors contributing to MA’s higher rates include:

- Dense urban areas with higher accident rates

- Severe weather conditions

- Higher cost of living, which affects repair and medical costs

What documents do I need to get an auto insurance quote in MA?

To obtain an accurate auto insurance quote in Massachusetts, have the following information ready:

- Driver’s license numbers for all drivers on the policy

- Vehicle registration and VIN (Vehicle Identification Number)

- Current insurance declaration page (if you have existing coverage)

- Driving history, including accidents and violations

- Bank information or credit card (if you plan to purchase the policy immediately)

How long is an auto insurance quote valid in Massachusetts?

The validity period of an auto insurance quote in MA can vary by insurer, but typically:

- Most quotes are valid for 30 days

- Some insurers may offer quotes valid for up to 60 days

- Quotes for high-risk drivers or unique vehicles may have shorter validity periods

Always check the expiration date on your quote and be prepared to request a new one if your circumstances change or if the quote expires before you make a decision.

Conclusion

Navigating the world of auto insurance quotes in Massachusetts can seem daunting, but armed with the right information, you can make informed decisions that protect both your vehicle and your finances. Here’s a recap of the key points to remember:

- Understand MA’s minimum coverage requirements and consider additional coverages for comprehensive protection.

- Explore multiple avenues for getting quotes, including online tools, local agents, and comparison websites.

- Be aware of the factors that influence your rates, such as driving record, vehicle type, and location.

- Take advantage of discounts and strategies to lower your premiums.

- Avoid common mistakes like not shopping around or focusing solely on price.

- Understand the components of your quote and how to compare offers from different insurers.

- Consider MA-specific factors like the SDIP and seasonal considerations.

Remember, the best auto insurance quote in MA is one that balances comprehensive coverage with affordable premiums, tailored to your specific needs and circumstances. Don’t hesitate to ask questions, seek clarification, and regularly review your coverage to ensure you’re always adequately protected on Massachusetts roads.

By taking the time to thoroughly research and compare your options, you can drive with confidence knowing you have the right coverage at the best possible rate. Stay informed, drive safely, and enjoy the peace of mind that comes with proper auto insurance coverage in the Bay State.

Leave a Comment